Cannabis Related Business

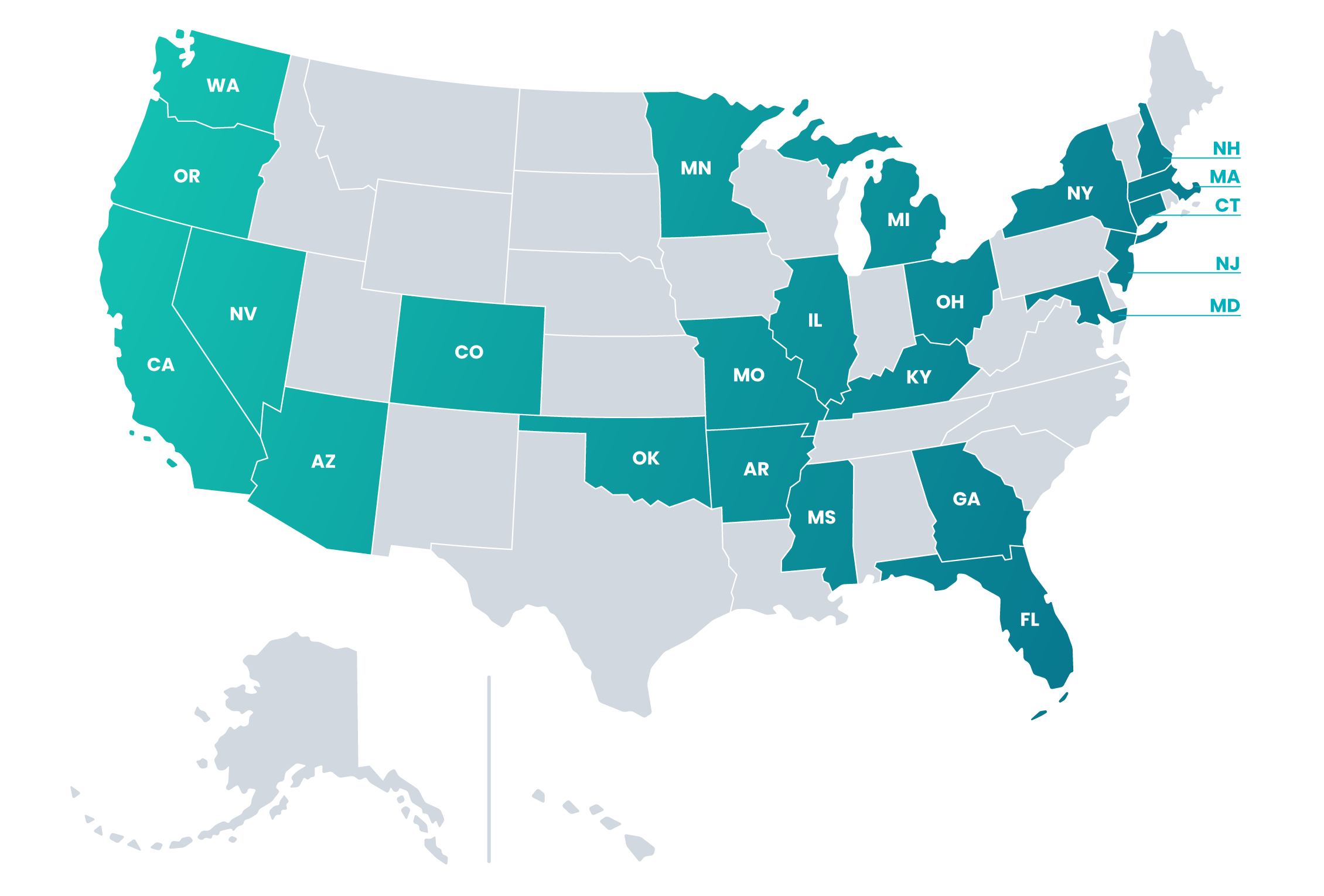

Experience Cannabis Banking, the FFB Way. Our specialized team, operating across more than 20 U.S. states, understands the unique challenges of your business. Let us handle the complexities of cannabis banking, so you can focus on growing your business. We're committed to providing tailored solutions that keep pace with the dynamic market.

Business Accounts

FFB has been helping businesses and our communities grow for more than 100 years. We have a complete suite of products and services designed to improve your business's cash flow and financial position.

Business Loans

Ready to take your business to the next level? Apply for an FFB business loan today. Reach out to our CRB Sales Team for details.

Contact CRB Sales Team

1-866-420-4118

Treasury Services

As your business grows, your cash management needs change. We offer business services at every level, from basic depository services and Business Online Banking to Wholesale Lockboxes and Positive Pay.

Cannabis Services and Features

Armored Car Services

Lock Box

Online and Mobile Banking

Electronic Payments

Merchant Services

Debit Cards

And More...

VP, Cannabis Banking Manager

Ph: 1-866-420-4118

Jim Shepard is the Cannabis Banking Manager at First Fidelity Bank (FFB), a specialty segment of commercial banking. Jim and his team provide specialized banking and treasury management solutions for cannabis-related businesses (CRB). Since 2016, Jim has led the development of FFB’s CRB program, considering the dedicated needs of cannabis-related businesses and regulatory requirements. He began his 35+ years of commercial banking with a focus on treasury management sales. During this time, Jim has established an extensive knowledge base of the various treasury management solutions that provide operating efficiencies and cost-saving benefits for his clients.

First Fidelity Bank partners with Green Check Verified to bring greater assurance to our cannabis banking services. Green Check's platform powers our compliance framework, allowing us to serve licensed cannabis businesses with transparency and trust confidently. This ensures we meet rigorous regulatory standards while supporting a growing industry.

Green Check Frequently Asked Questions

Link to Green Check Support FAQ

What is FFB Green Check?

Green Check is a software company that helps cannabis-related businesses and financial institutions work together. Our cannabis banking platform is purpose-built to support the unique oversight and reporting needs of both the business and the bank. Our mission is to help cannabis businesses access the basic financial services that can help them grow and keep their communities safe.

Why do I need to use FFB Green Check?

FFB uses the Green Check system to manage all their cannabis-related business accounts. Our system allows them to collect the necessary documentation and maintain the required oversight to satisfy their regulations surrounding banking the cannabis industry. They also use our system to validate that transactions are happening between legally licensed businesses/individuals to demonstrate that funds deposited to the bank are from legal marijuana sales.

How much does FFB Green Check cost?

There is no additional fee to customers for the use of Green Check.

How will FFB Green Check use my data?

The Green Check system provides a simple way to share your sales activity with your financial institution. Direct integration with your point of sale or invoice tracking software helps to automate this process. The Compliance Rules Engine checks each sale to make sure it complies with the regulations governing cannabis sales in your state. Green Check does not own your data, nor will we ever sell it to a third party. Your data remains your data.

Why does my bank need my sales activity?

FFB is required to gain and monitor sales activity data to comply with banking regulations. It is required to match sales activity with deposits made into your FFB account. This helps ensure customers are only depositing money made from legal operations. To do this, verified sales follows the cannabis sale laws set forth by each state cannabis program.

How do I upload sales to FFB Green Check?

Why do I need to record my deposits in FFB Green Check?