Your Finances, Clearly Connected

What's New

- A modern, streamlined look across web and mobile

- Smarter transaction categorization

- A more flexible dashboard and improved insights

- Faster, more reliable connections to your external accounts

How to Get Started

To get the most out of the enhanced tools, you'll need to:

- Reconnect any external accounts you currently aggregate

- Recreate your budgets and savings goals within the new layout

- Adjust your dashboard to match your preferences

Features

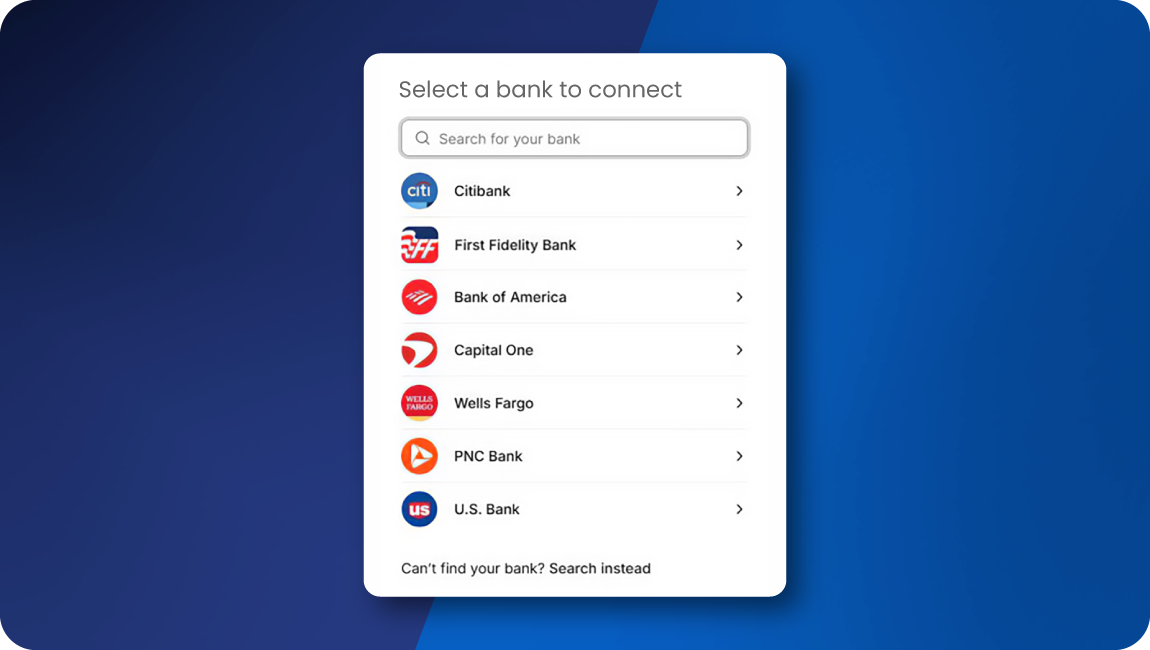

Add External Accounts

Aggregate accounts from more than two thousand banks and credit unions to view all your financial accounts in a single location. See balances, institutions, and account types at a glance.

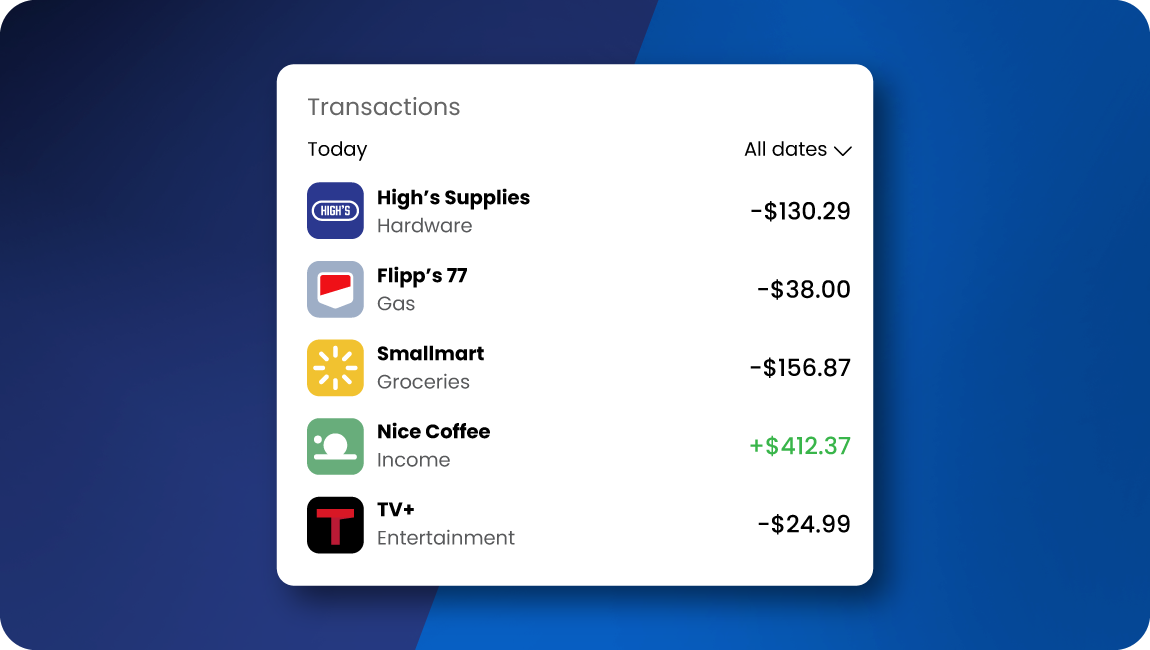

Transactions

View all your transactions in a single enriched feed featuring automatic categorization, merchant identification, and analysis of regularity to help you recognize patterns and plan ahead.

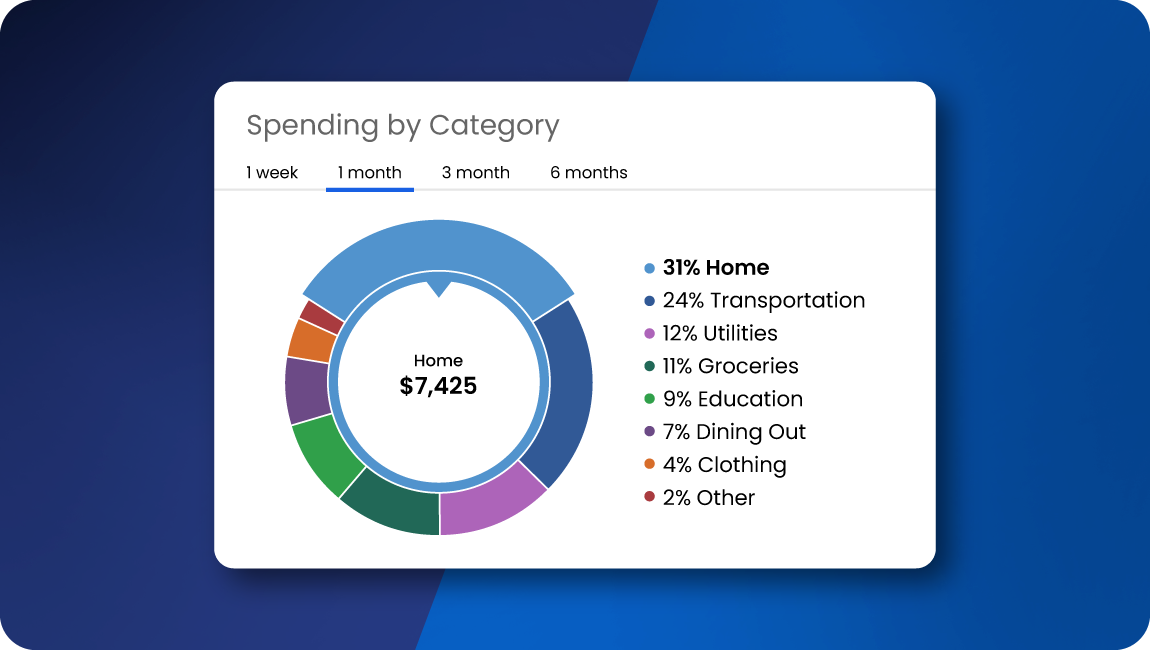

Spending Wheel (app version coming soon)

Identify at a glance where your money is going with a visual breakdown of your spending habits by category.

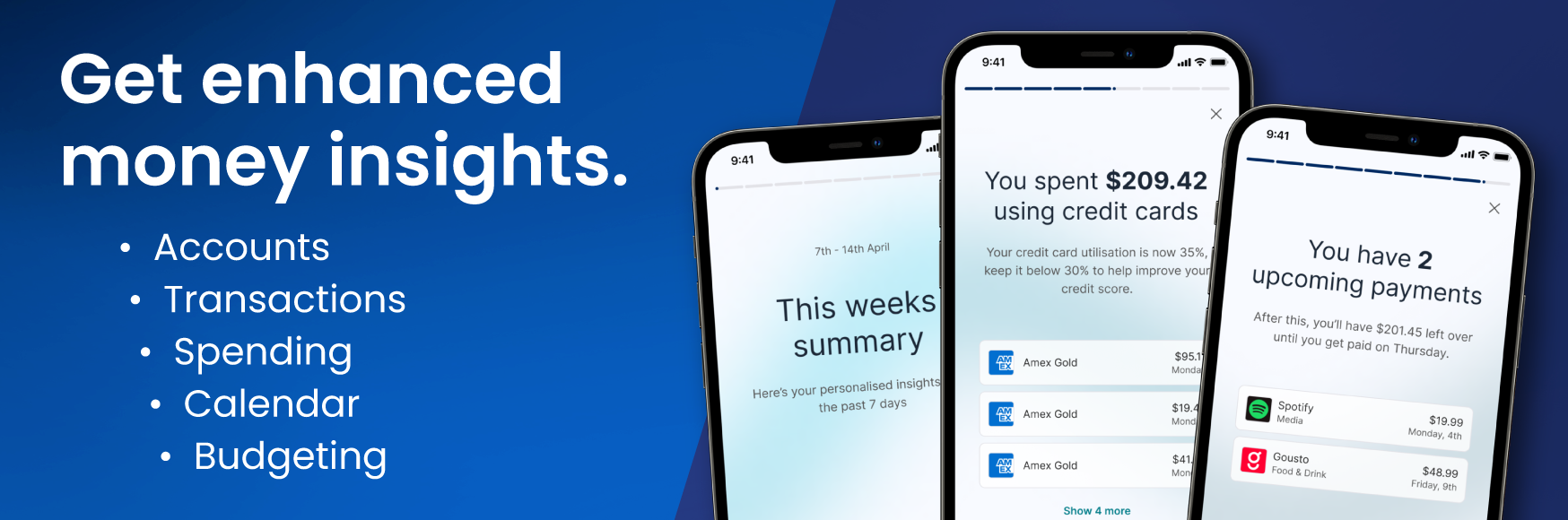

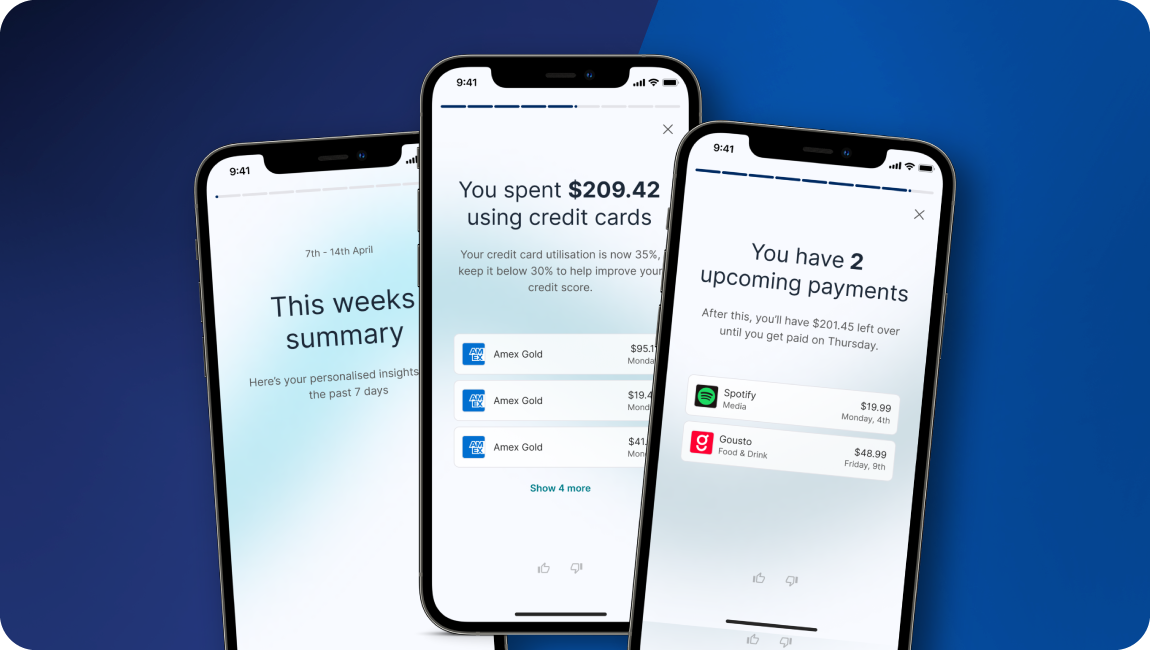

Weekly Summary

Get a personalized weekly summary of your current finances, complete with insights and a forecast of your upcoming income and payments

Financial Calendar

Monitor your daily spending to see if it’s low, average or high compared to the last three months. Check upcoming bills and view a forecast of future transactions based on past habits.

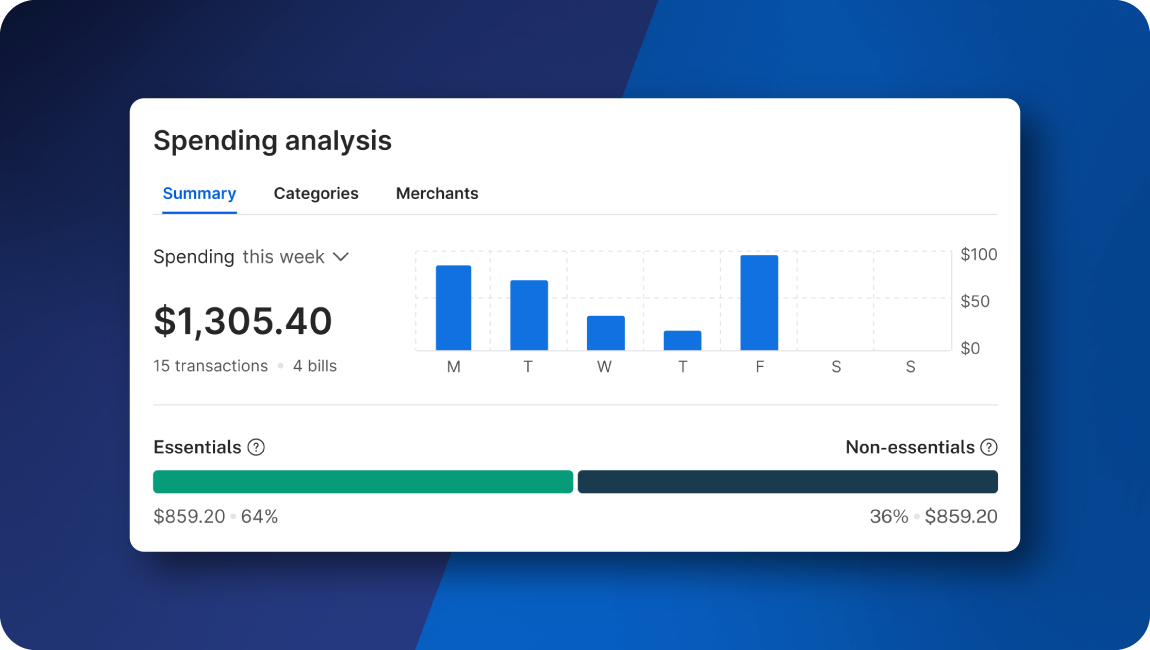

Spending Analysis

See a detailed breakdown of where your money goes. Analyze spending by week, month, or year, categorized by merchant and type of purchase.

Spending Budgets

Monitor your spending and stay on track by creating budgets for specific categories and merchants. Get gentle nudges when you’re nearing a limit and celebrate wins when you stay under budget

Balances Over Time

Track your accounts’ balance history to gain insight into both short-term and long-term trends. Identify seasonal changes and progress over time.

Frequently Asked Questions

Why are we enhancing the GoBankFFB experience?

To deliver more reliable account connections, modernized budgeting tools, and expanded insights, aligned with our long-term digital strategy.

Will I lose my historical data?

Your GoBankFFB account data remains. Some external account history may take time to refresh after reconnection.

Do I need to reconnect my external accounts?

Yes—reconnection is required to continue aggregating balances and transactions from other institutions.

Where did budgeting and goals move?

You’ll find budgets and goals under Money360 → Budgets. A guided tour will highlight what’s new.

Is my data secure?

Yes. Account connections are encrypted and handled using industry best practices. We never share your credentials.

Can I customize my dashboard?

Absolutely. Rearrange widgets, choose your timeframe, and pin your most-used views.

Who can help if I get stuck?

If you’d like help reconnecting accounts or adjusting your settings, contact our Customer Service department. You can also visit any branch and a banker will be happy to guide you through the steps.

Need Help?

We’re here to help you get set up and answer questions.

- GoBankFFB in-app message

- Live Chat on ffb.com

- Call Us: 800-299-7047