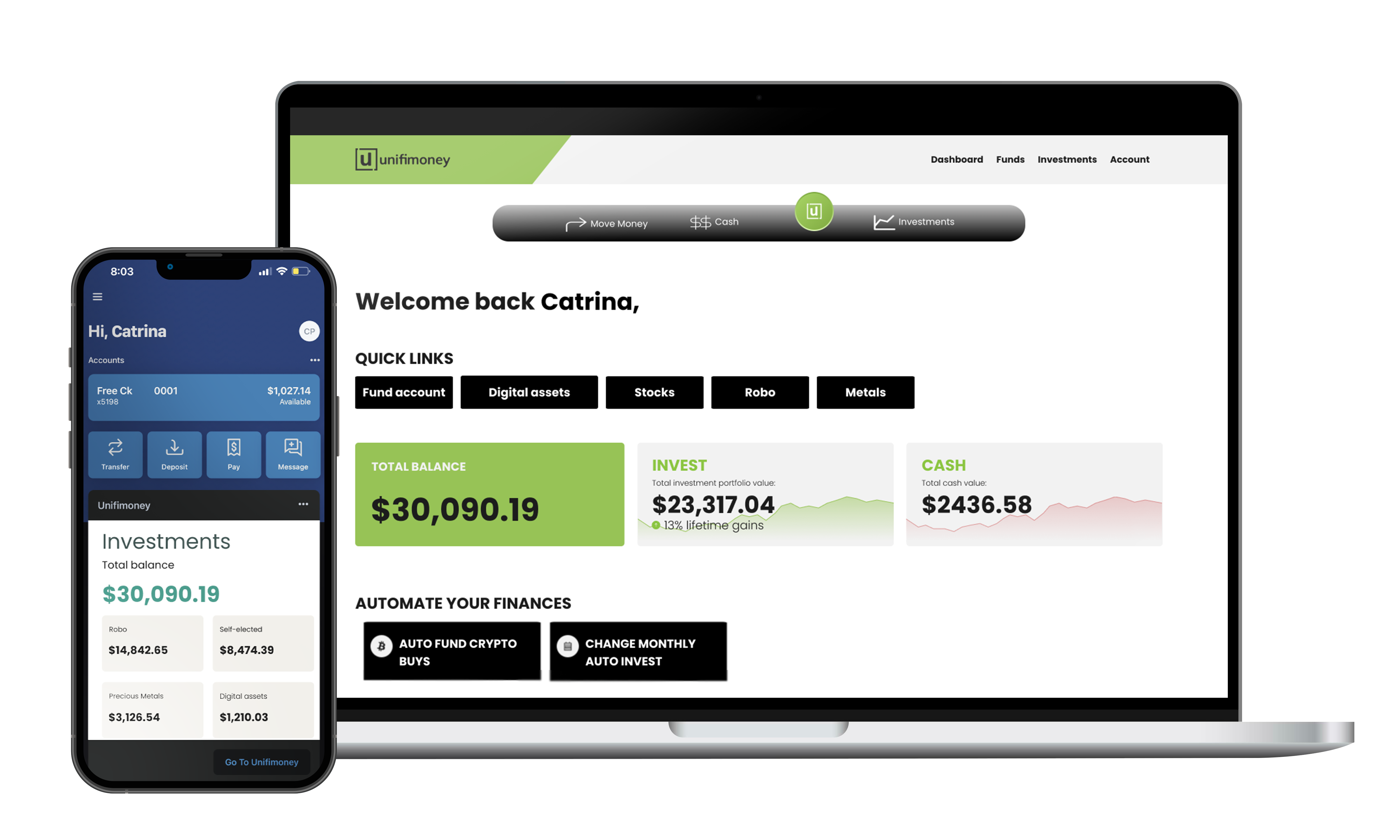

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance.

Investment advisory services are provided by Unifimoney RIA QOZB,LLC, an SEC-registered investment advisor. For important information and disclosures , visit the Unifimoney Legal Library at www.unifimoney.com/legal.

Bank Products: Unifimoney is not a bank. The Cash Account is provided by First Fidelity Bank (FFB) www.ffb.com, member FDIC. The cash balance in the Cash Account may earn a variable rate of interest and is eligible for FDIC insurance. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. FDIC insurance only covers failure of an insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. For more information on FDIC insurance coverage, please visit www.FDIC.gov. The Cash Account is not covered by SIPC.

Brokerage account services are offered through Apex Clearing and Custody, Inc. ("Apex"), a registered broker-dealer, member of FINRA and SIPC. Your cash and investments are protected by SIPC up to $500,000, with a limit of $250,000 for cash. Deposits at Apex are NOT deposits or other obligations of and are NOT guaranteed by First Fidelity Bank. Not FDIC insured-May lose value.

Digital Asset Products: Investing in digital assets involves risk, including risk of loss. Digital assets are highly volatile, can become illiquid at any time, and is for investors with a high-risk tolerance. Investors in digital assets could lose the entire value of their investment. Custody and trading of digital assets are provided by Gemini Trust Company, a New York State-chartered limited liability trust company. Digital assets are not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation (“SIPC”)." and is NOT a deposit or other obligation of FFB Bank.

Precious Metal Products: Precious Metal trading is offered through GBI, a New-York-based precious metals dealer. Deposits at GBI are NOT deposits or other obligations of and are NOT guaranteed by First Fidelity Bank NOT FDIC insured.