A First Fidelity Bank IRA can help secure financial security...

- IRAs are insured separately by the FDIC regardless of additional First Fidelity account relationships...

- Contributions to an IRA account may be made up until the designated personal tax filing date, generally, April 15th following the end of the tax year

Contributions may be made to an IRA throughout a current tax year

First Fidelity Bank offers a variety of IRA options to meet your needs. Click below to learn more about the various options.

Traditional IRA

Interest is tax deferred. In some cases, the contributions to a Traditional IRA is tax deductible. The individual may not be a participant in an employer-sponsored pension or profit sharing plan and must meet IRA income requirements.

ROTH IRA

Interest earned is tax free. All withdrawals, including earnings, are tax free if the account has been opened for five years and the account holder is age 59 1/2 or older. Withdrawals that do not include earnings are tax free at any time. Consult a tax advisor.

Other IRAs

Other IRAs are available through First Fidelity Financial Group.

Securities products are offered through Cetera Investment Services LLC, member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with First Fidelity Bank. Advisory services are only offered by Investment Adviser Representatives.

Enter promo code "Woligo" in your application.

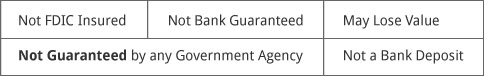

Investments are:

If you have questions or would like more information, you can call us at (888) 633-5229.

Toggle other rows

Toggle other rows

Should I open a Roth IRA? A Traditional IRA? Or put a little money in both? These are questions many taxpayers ask.

Is it beneficial?

Generally, a Traditional IRA may be beneficial if you are eligible to make deductible contributions and expect your tax rate during retirement to be lower than it is today. On the other hand, a Roth IRA may be a wise choice if you expect your tax rate to be the same or higher during retirement.

The answer depends on each unique situation, and a Financial Advisor can help you choose an IRA that's right for you.

First Fidelity Bank offers an IRA to fit your specific goal. For more information, call us or stop by one of our convenient neighborhood locations. Contact your tax advisor for specific tax savings.

Types of IRAs

Traditional IRA

Interest is tax-deferred. In some cases, the contributions to a Traditional IRA are tax-deductible. The individual may not be a participant in an employer-sponsored pension or profit-sharing plan and must meet IRA income requirements. Clients should consult with a tax advisor if questions arise.

Roth IRA

Interest earned is tax-free. All withdrawals, including earnings, are tax-free if the account has been opened for at least five (5) years and the account holder is age 59½ or older. Withdrawals that do not include earnings are tax-free at any time. Clients should consult with a tax advisor if questions arise.

Conversion from Traditional to Roth

Conversion from a Traditional IRA to a Roth IRA may be beneficial to a client. Many clients take advantage of the conversion rules. Income restrictions to convert change periodically. For correct information, access the IRS site for information (see below in Helpful Links). Clients should consult with a tax advisor before conversion to clarify tax consequences and to ensure advantages and their eligibility to convert.

What are the tax advantages?

Traditional IRA: Tax-deferred 1

Investment growth is tax-deferred and you may be eligible for a tax deduction on your contributions. You won't pay taxes on deductible contributions or any earnings until you withdraw money.

Investment growth is tax-deferred and you may be eligible for a tax deduction on your contributions. You won't pay taxes on deductible contributions or any earnings until you withdraw money.

Roth IRA: Tax-free 2

Investment growth is tax-free when withdrawn as part of a qualified distribution (as defined by the IRS). Refer to What are the withdrawal rules? below.

Investment growth is tax-free when withdrawn as part of a qualified distribution (as defined by the IRS). Refer to What are the withdrawal rules? below.

1 Tax-deferred growth means the individual delays paying Federal income tax on earnings until money is withdrawn from the retirement plan.

2 Tax-free means free from Federal income tax.

Is my contribution tax deductible?

You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your IRA. See IRA Contribution Limits.

Is there an age limit for contributions?

IRA contributions after age 70½

For 2020 and later, there is no age limit on making regular contributions to traditional or Roth IRAs.

For 2021, if you’re 70 ½ or older, you can't make a regular contribution to a traditional IRA. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age.

Are rollovers and transfers permitted?

Traditional IRA: Yes, you may roll over or transfer to and from other Traditional IRAs or qualified employer-sponsored plans. In 2021, all IRA owners will be able to convert their Traditional IRA to a Roth IRA.

Roth IRA: Yes.You may roll over or transfer to and from other Roth IRAs. You may also convert a Traditional IRA or roll over an employer-sponsored retirement plan to a Roth IRA. For 2021 conversions, there is no MAGI requirement.

What are the withdrawal rules?

Play video

Play video

Play video